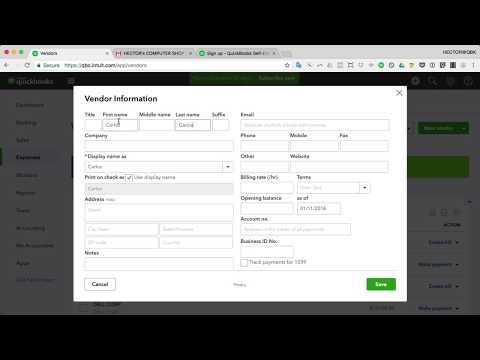

Conference, now let me jump into my topic before we pass it on to Greg and Dawn. - I'm going to quickly cover the new 1099 miscellaneous forms in QuickBooks Online. - First of all, let me say, in my opinion, one of the best things I've seen Intuit do for the QuickBooks Online product in a very, very long time. It is absolutely amazing, and I'm super happy about how simple and easy it is to use. - So, let's jump to that. Let me go into Chrome. I think you should be able to see my browser now. And I have a QuickBooks Online account open. - One of the things that is noticeable is they added a new tab called "workers". If I click on the new tab called "workers", you're gonna get a basically looks like a new screen that splits employees and contractors as two different sub-tabs. - A contractor in QuickBooks is basically a vendor that has been marked as a 1099 contractor. Let me explain what that means. - So, if I go into the expenses tab and go to the vendor tab, which is a traditional place where we create our vendors, and I create a new vendor from this screen, let me click on new vendor. - And I'm going to create here Carlos Garcia. There's a little check here that says "Track 1099 payments". So, if we are dealing with a contractor that we want to issue a 1099 at the end of the year, we have to hit that check. Whenever we hit that check, QuickBooks will copy that vendor information over to that workers' contractors section, which is then where you're going to be able to manage all the 1099 information. - Now, in order to do a 1099, you need to have a tax...

Award-winning PDF software

Substitute 1099-s 2025 Form: What You Should Know

Form 1099-S This form is used to report a sale, exchange or other payment of money on the sale or exchange of property, an improvement or an indebtedness on real estate IRS Form 1099-S, Other Real Estate Transactions A form 1099-S is a tax document used to ensure that the full amount received for a real estate sales of some kind is accurately reported. IRS Form 1099-S, Proceeds from Real Estate Transactions A form 1099-S is used to report the income from the sale or exchange, the payment of money (cash price) received for the sale or exchange of property or the payment of real property debt on real estate in some type of sale or exchange. IRS Form 1099-S, Real Estate Sales This is a tax document used to report the income on the sale or exchange of real property. It may only be used for reporting the total gross proceeds of a real estate sale, even if the sale or exchange occurred by IRS Form 1099-S — Other Real Estate Sales (Info Copy Only) This form is designed for reporting a transaction that may consist of the complete or partial sale or money exchange of real property. This form is for reporting the gross proceeds from the sale or exchange of real property. For reporting proceeds from the sale or exchange of real estate, you may have to fill out a substitute form 1099 S. If you receive an amount from a sale you entered into yourself, this form is for filing a Form 1099-S should have been filed by the time you file your tax return. It's important to know the proper procedures. If you have any doubts regarding the need to use a form 1099-S, follow the steps that include: Find out if the property was sold under a contract or is a personal realty sale. If the property was sold under a contract go ahead and fill out the Form 1099-S. If it was not a contract sale for personal realty, then fill out a Form 1099-S — Other Sales of Real Property If the sale is for an improvement, a mortgage, or a mortgage on a condominium unit you must determine if the real property is on a Condominium. If it's on a Condominium, you must follow the filing instructions for Form 3355 for reporting the sale of a personal realty home.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-S Substitute Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-S Substitute Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-S Substitute Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-S Substitute Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Substitute Form 1099-s 2025