Hi guys, this is Vanessa Cruz with Crews Consulting. Today, I wanted to go over with you the importance of 1099 forms. 1099s are an IRS form that you need to distribute to your contractors by January 31st. So, that's the first thing to keep in mind. The second thing to consider is how much you've paid your contractors on a cash basis during the previous year. If the amount exceeds six hundred dollars in aggregate, those individuals should receive a 1099 form. Lastly, you need to determine who should receive these 1099s. The answer is anyone who is not a corporation. This includes LLCs, sole proprietors, contractors, lawyers, and landlords. To confirm their legal status, you can obtain a W-9 form from them. Remember, 1099 forms are due by January 31st. You should provide one to anyone you've paid over six hundred dollars and anyone who is not a corporation. Thank you for checking us out. We're Crews Consulting. Music.

Award-winning PDF software

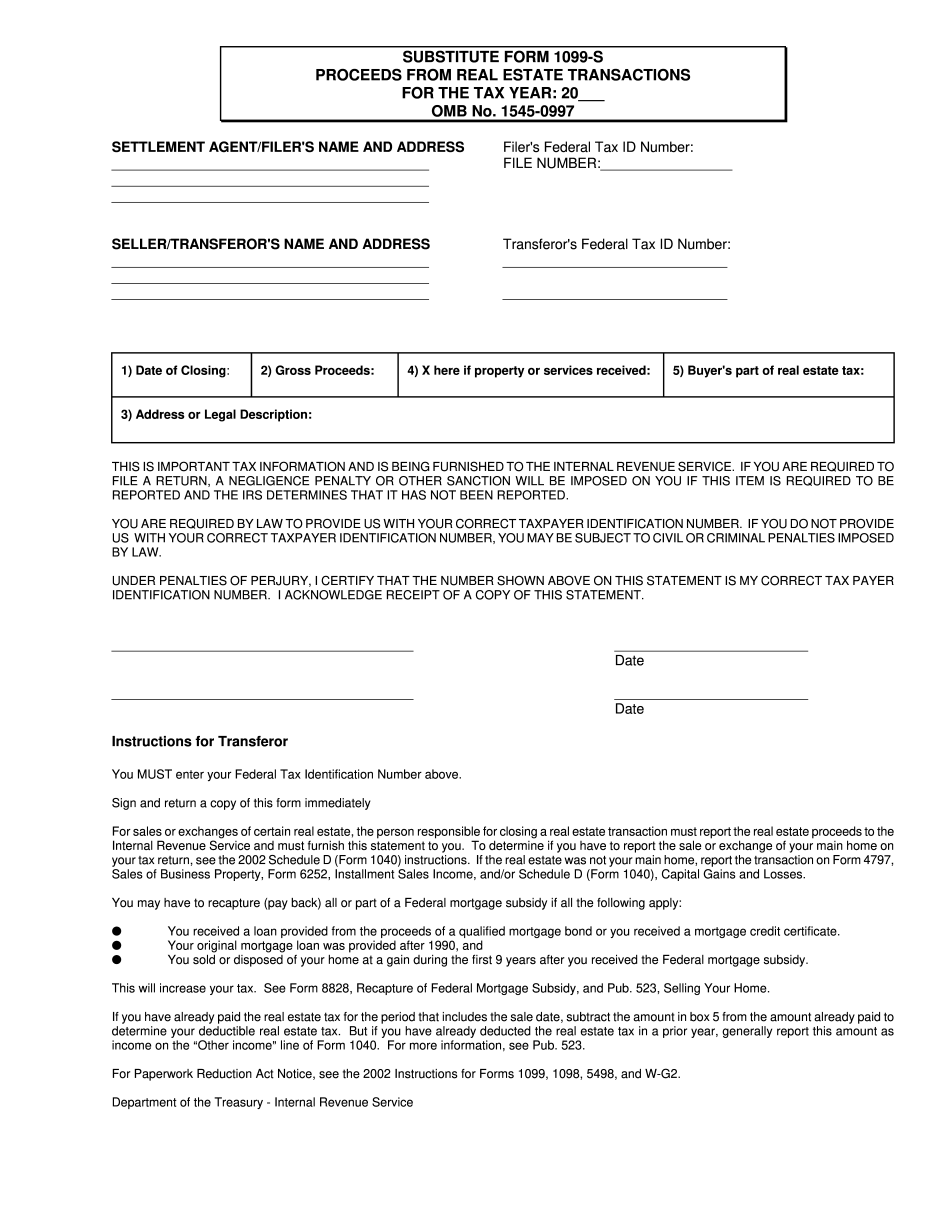

Who sends 1099 S s out Form: What You Should Know

The information that it contains is important to a number of tax situations such as estate tax and dividend reporting. There's some confusion around this IRS form because the name “1099” is used on the form and the forms are sold by mail under the name 1099-MISC. They appear to be the same tax form. The IRS does not use a name for a single type of tax form that they issue, but instead gives guidance throughout the tax code on how to use a particular type of tax form. Taxpayers and the IRS do not refer to a “1099” or the code 1099, and instead use the name 1099. The term “Federal tax” that appears on Form 1099-MISC is used to refer to the federal form 1099; therefore you report as income to government through the 1099. The IRS calls Form 1099 “Form 1099-MISC,” but it does not mean they don't make any distinction between 1099-MISC and the others types of Forms and the tax forms they issue. So for the most accurate information, call your broker, real estate agent, or lender and ask them what they think of 1099-MISC. Get a copy of the IRS 1099-MISC. For example, it's 1090-S, “Annual Income Tax Return for Individuals Under Age 65” What is a Title Company? The title company is the person or legal entity that purchases the title to your home from your family and you. The title company holds title to your home on your behalf, and in addition to recording sales they also may provide you with certain services such as closing and insurance. (Some home sellers may have their title company do those services in conjunction with the title transfer for insurance.) In general your home title company is a third party that sells you the title and does not own your home. Home Title Company and Seller's Liability Home titles and title insurance are separate from seller's liability because the title company is selling the title to you, and it is not responsible for the sale. Title company liability only arises when you make a false statement or fail to disclose material facts to the title company. The owner(s) of a mortgage loan are not liable for the loan unless they knowingly consented to the sale of (or were directly party to the loan sale) the mortgage loan.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-S Substitute Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-S Substitute Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-S Substitute Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-S Substitute Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Who sends 1099 S forms out