Music. Hi, I'm Kate Finch with PM Title. What is a 1099-S? The purpose of IRS form 1099-S is to ensure that sellers are reporting their full amount of capital gains on each year's tax return and thus paying the appropriate amount of taxes to the IRS. As a title company, we are required to collect certain information regarding the sale of your property and file the 1099-S with the IRS. We are required to collect your social security number and mailing address. 1099-S forms are mailed out in January of the year following the sale of your property. Did you or your client recently receive a 1099-S in the mail? The most commonly asked question is why does the amount on the 1099-S not reflect the amount listed on the check that I received at closing? The amount listed on the 1099-S is for the gross proceeds from the sale of your property. In other words, if you sold your property for $100,000, then the amount listed on the 1099-S would be $100,000. If you and a family member sold a property for $100,000 and split the proceeds 50/50, then you would each receive a 1099-S for $50,000. If you receive a 1099-S, please take this form along with a copy of your settlement statement to your accountant. Your accountant will determine whether or not you have any tax due. That is today's tip. If you have any additional questions, please email me at kate@pmtitle.com or you can call the office at [phone number].

Award-winning PDF software

1099-s fillable 2025 Form: What You Should Know

The 1099-S form reports all the following property and proceeds from the sale. The property included in 1099-S payments is your home. See the links under “Questions to Ask Your Financing Institution” to see if you may have to report these income items on Schedule SE or Schedule SE P, and whether you must complete and file a state income tax return. Form 5498 or Form 5498S (and any state equivalent) Form 5498 and 5498S are used to report the sale of a principal residence or retirement plan (a private pension or profit-sharing plan). The Form 5498S is used to report the proceeds from the sale of a vacation property for the year. If you have both, you would complete both. IRS Form 706—Sales and Donations Use Schedule A or Schedule C to report the proceeds from the sale of real property. Schedule A shows the sale proceeds and Schedule C shows the donor's share (or a portion of their share). To complete a Form 706, complete Schedule A as shown on these instructions and then attach Schedule C to that schedule, using that schedule as a substitute for Schedule A. Form 1320 — Exclusion From Income The Form 1320 is an annual form that provides information required in calculating adjusted gross income. There are three types of filers: One who is married and each spouse holds more than one separate property One who is married and each spouse holds one or more separate properties One who is married and each spouse holds none of the following One who pays more than half of their own income (including all the income for their dependent) The Form 1320 calculates the income earned from holding real estate, such as a home and a vacation home. If you have both property and income from rental properties, use one or the other. For example, if you own a house in two places, and your income for 2025 comes from only one (your one main home in Washington State) and you also own a vacation house in another state, your Form 1320 for that year would report the income from one or the other property. Your total income from both properties is the excess over the net income for the year. See instructions for Schedule A and other instructions for Schedule C of Schedule E of its book.

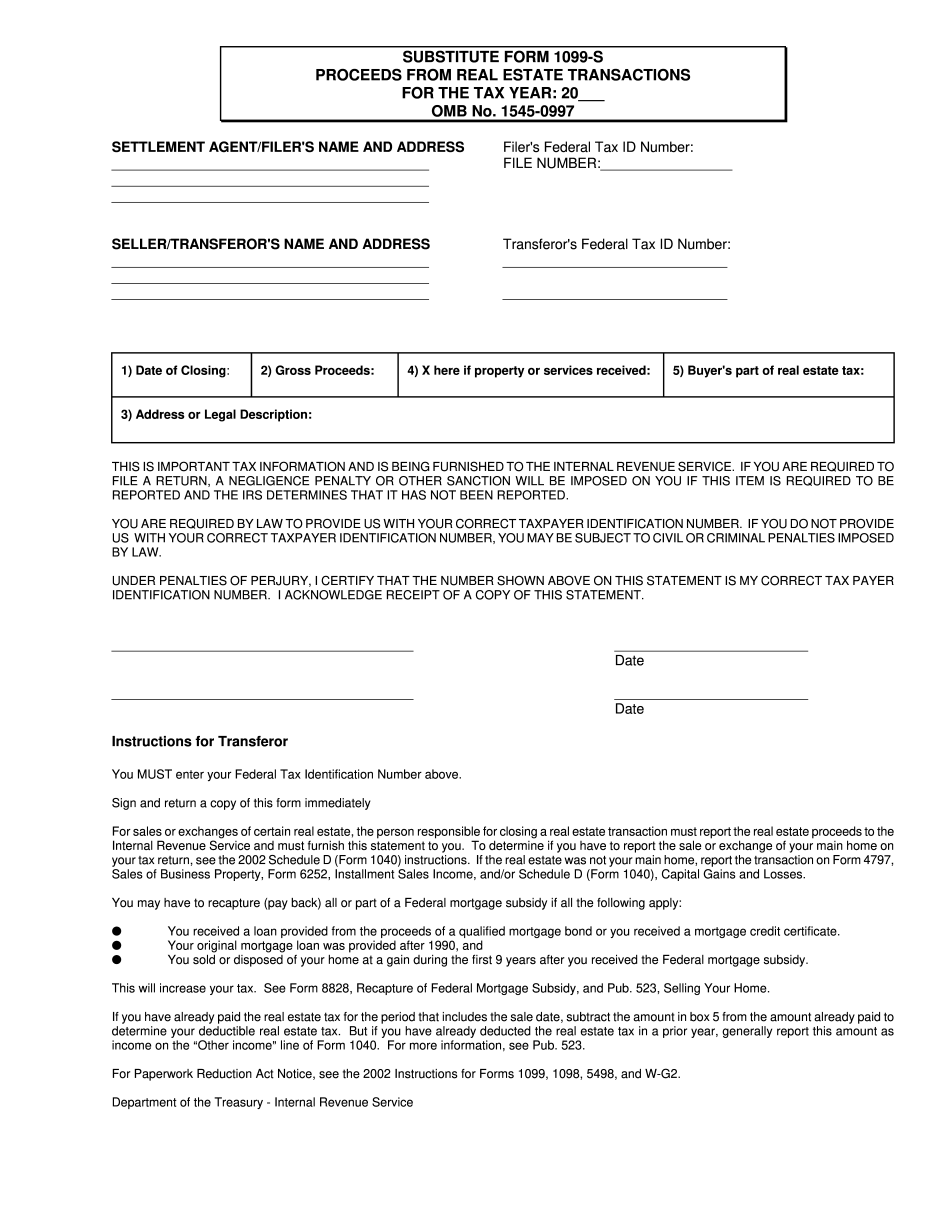

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-S Substitute Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-S Substitute Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-S Substitute Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-S Substitute Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099-s fillable form 2025