Award-winning PDF software

All About 1099-S Forms - Land Title Guarantee Company: What You Should Know

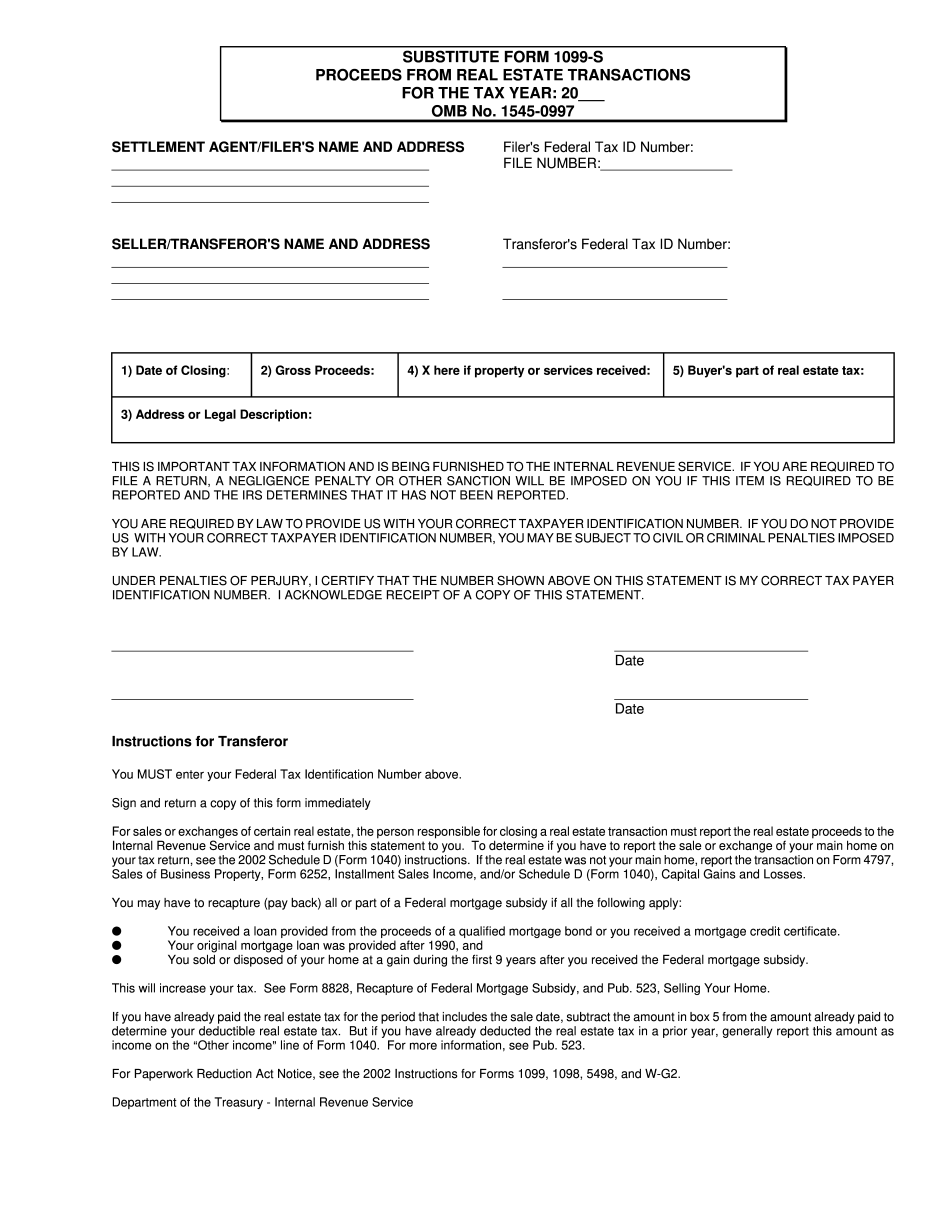

Forms Required for Filing a 1099-S Form 1099-S: The Real Estate Sale Exempt from Sales and Use Tax Jan. 13, 2025 — A Form 1099-S is the document that your title company uses to collect the money from the sale of your property to the purchaser, if any. Learn more. Forms Required for Filing a 1099-S Form 1099-S: The Real Estate Sales Profit Exempt from Tax January 1, 2025 — This form must be filed to have any title company get this money in your account from the sale of your property. Learn more about how the sales price applies to your Form 1099-S. Forms Required for Filing a 1099-S Form 1099-S: The Real Estate Property Tax Exemption July 1, 2025 — Get a break on your property tax bill. If any real estate is sold, the sales tax will be credited based on the sale price of the property. Learn more. Colorado 2% Withholding Jan. 24, 2025 — All about withholding on your Form 6166 for Colorado. Learn more about Colorado 2% withholding. How to File a 1099-S: The Sales and Use Tax Issue Feb. 24, 2025 — With your sales receipts, the IRS gets a real picture of the cash you get from the sales of real property; this is the form it will use to determine its position on your tax return. Learn more about what happens on the 1099-S report. If You Get a 1099-S Tax Document As a seller, you can request an amended 1099-S form from your title company when a sale takes place. You are only entitled to have the original 1099-S certified by the seller, or by one of the following two certifiers: the seller's agent, or a title company agent authorized to act on their behalf. As a buyer, it is highly recommended that you obtain a tax exemption certificate through your title company before your purchase. As a seller, it's up to you to make sure you get the appropriate tax exemption certificate.

Online options make it easier to to organize your document management and supercharge the productivity of your workflow. Adhere to the short tutorial in an effort to carry out All About 1099-S Forms - Land Title Guarantee Company, keep clear of mistakes and furnish it in a well timed manner:

How to accomplish a All About 1099-S Forms - Land Title Guarantee Company on the net:

- On the web site along with the type, click Get started Now and go to the editor.

- Use the clues to complete the relevant fields.

- Include your personal info and speak to data.

- Make certain that you enter proper info and quantities in acceptable fields.

- Carefully examine the subject material from the sort too as grammar and spelling.

- Refer that will help segment if you have any inquiries or address our Aid workforce.

- Put an digital signature in your All About 1099-S Forms - Land Title Guarantee Company along with the guidance of Indication Device.

- Once the form is done, press Done.

- Distribute the ready form by means of e-mail or fax, print it out or save on your system.

PDF editor permits you to make improvements towards your All About 1099-S Forms - Land Title Guarantee Company from any web connected machine, personalize it in keeping with your needs, sign it electronically and distribute in different strategies.