Award-winning PDF software

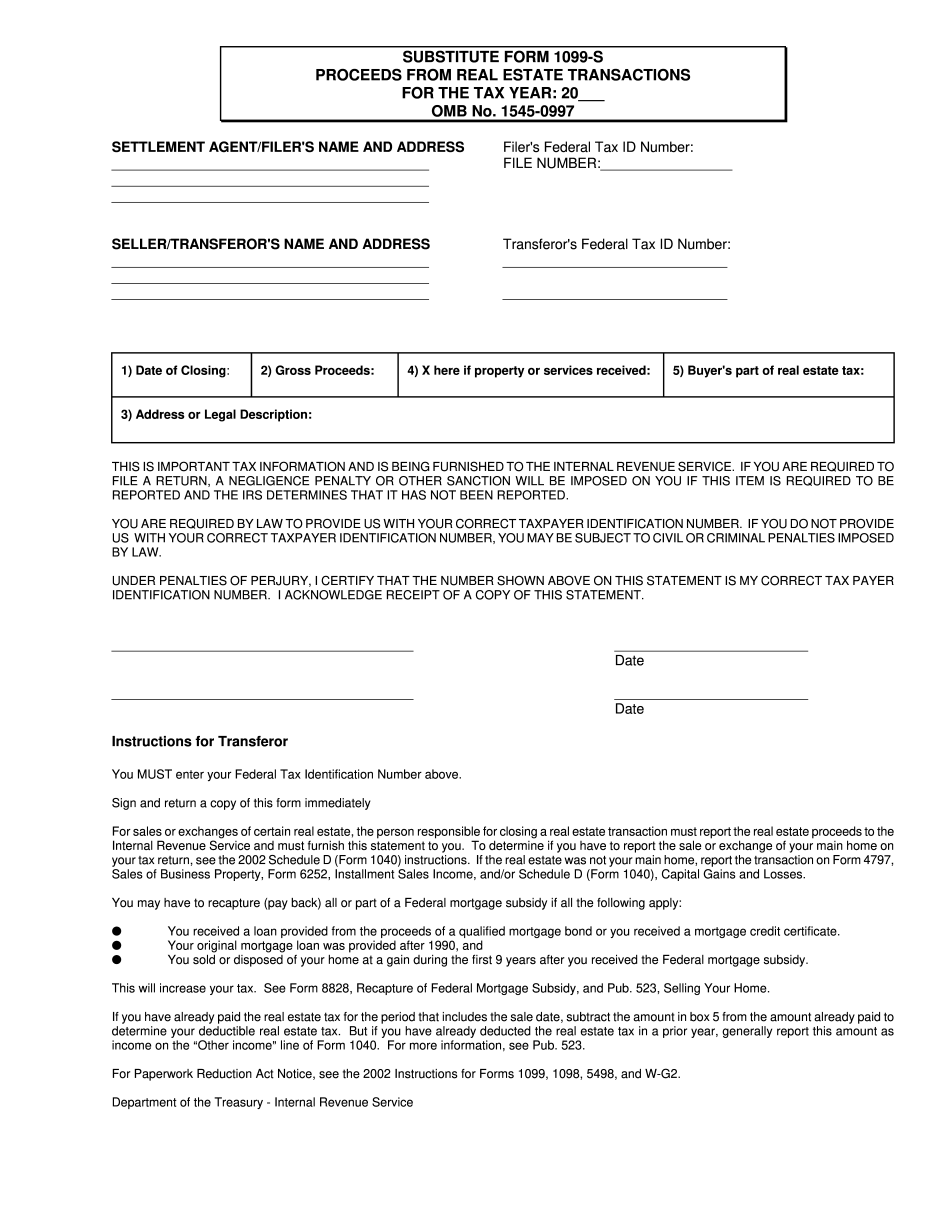

Little Rock Arkansas Form 1099-S Substitute Form: What You Should Know

S. Taxpayer identification number with respect to the gross payment amount in connection with which a Form 1099-K is required to be filed.... “Amounts received as compensation” does not mean an amount that is paid under the provisions of any contract, agreement, or understanding between the payee and the mayor. Payments include all payments for consideration, whether based on time, money or a combination of both.” Payments from the person who is not and is not entitled to a U.S. taxpayer identification number are not subject to IRC Section 956. As such, you do not need to prepare a Form 1099-K to report payments, and you should not include them on the IRS 1099A (and any other forms) if they are not received (3) Payments for consideration. Generally, you are required to never know who you are dealing with Jan 1, 2025 — A majority of you selected the correct answer: N. If a customer, who has a U.S. TIN, refuses to complete or sign the 1099-K Form. IRC Section 6050W — Thomson Reuters Notice on 1099-K Reporting of Gross Payment Amount With Certain Transfers IRC 6050W, requiring Form 1099-K reporting of gross payment amounts transferred between any payer that is an employee of the Payer, and any other payer, including the Payee's Payee, of consideration, as follows: (1) The term “consideration” has the meaning given the term by the terms of an agreement with a foreign person. Note: The term “consideration” includes, but is not limited to cash, property, and services. (2) If payments from the person who is not, and is not entitled to a U.S. taxpayer identification number are not reported, but gross payments from the person who is not, and is not entitled to a U.S. taxpayer identification number are reported, then the person who is not, and is not entitled to a U.S. taxpayer identification number should file a separate Form 1099-K for each gross payment amount reported.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Little Rock Arkansas Form 1099-S Substitute Form, keep away from glitches and furnish it inside a timely method:

How to complete a Little Rock Arkansas Form 1099-S Substitute Form?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Little Rock Arkansas Form 1099-S Substitute Form aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Little Rock Arkansas Form 1099-S Substitute Form from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.