Award-winning PDF software

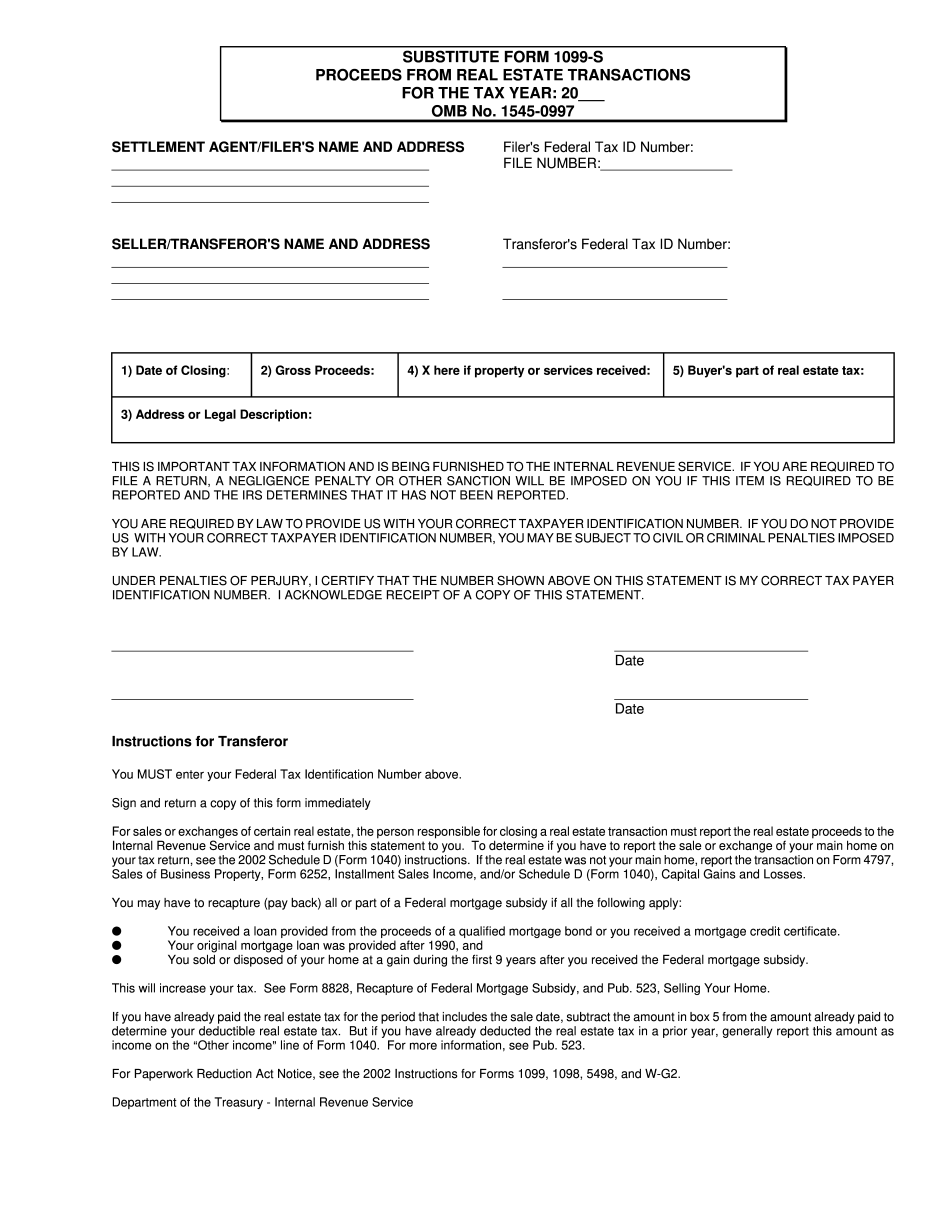

Modesto California Form 1099-S Substitute Form: What You Should Know

These regulations have been enacted to implement the provisions of Article VIII, Section 8, Section 9 of the California Constitution and to promote a fair and equitable treatment of the property and interests in property of the City of Modesto, including, to the extent they are applicable, the tax laws, the provisions of Article VIII, Sections 10-11, 11-19, and 40 of the California Constitution, and the provisions of Part 1, Section 10, Part 1, Section 11, Part 1, Title XX, Sections 1023, 1028, 1029, and 922 of the United States Constitution. Accordingly, these regulations provide for the taxation of interests in personal property; Taxation of Interest in Real Property Income Tax Act (“RITA”) This website may be used by any person located in the United States or its territories, and authorized by such person to make use of it to file an individual income tax return on behalf of that person for its personal tax year ending with or within the time period starting on April 18, 1995, and which ends with or within the time period ending on the date of the return, or beginning on the date thereof when that return is filed; and provided: that the return is filed in the United States and is made using an electronic filing system, and that the individual is the taxpayer of record, and that any tax paid or accrued as a result of the return and any refund issued is made within the time period described above. To file Form 1040 electronically, go to IRS.gov and under “File Online,” enter “1040 Electronic Return.” File Form 1040 by mail or in person. If you want to file a claim for refund of certain taxes paid on Form 1040, go to IRS.gov and under “File for Tax Return,” choose “Form 1040.” Complete and mail Form 1040. The person who filed your tax return is called the paying agent, not the taxpayer. If you are not the paying agent, go to IRS.gov and enter “I am not the paying agent”, and then click on the button to file a claim. In the “Claim Now” section, enter your name, taxpayer identification number (TIN), and EIN for identification purposes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Modesto California Form 1099-S Substitute Form, keep away from glitches and furnish it inside a timely method:

How to complete a Modesto California Form 1099-S Substitute Form?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Modesto California Form 1099-S Substitute Form aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Modesto California Form 1099-S Substitute Form from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.