Award-winning PDF software

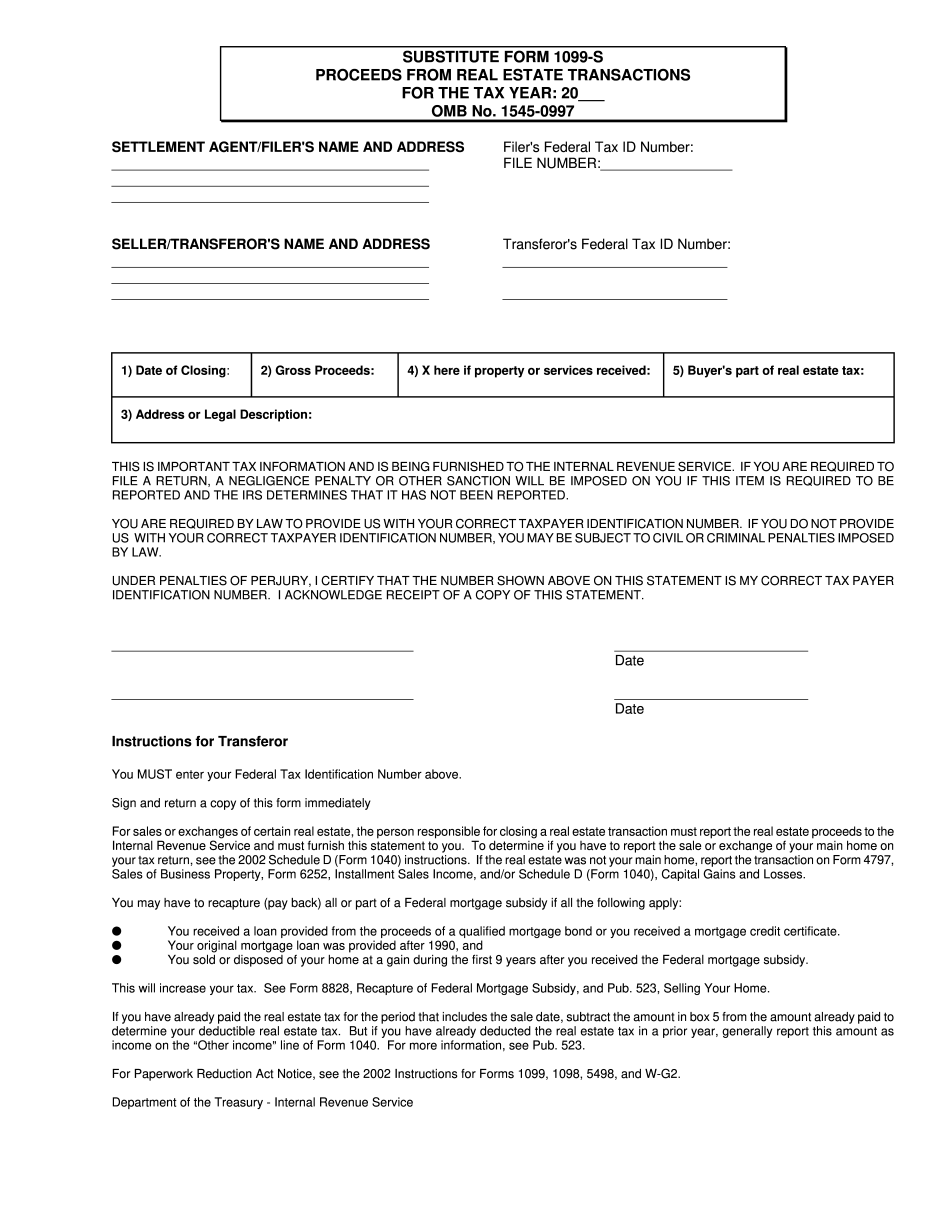

Printable Form 1099-S Substitute Form Wichita Falls Texas: What You Should Know

I received a tax form that I didn't know was required. It's called a 1099-K, and it can get you into some trouble with the IRS and/or the IRS is the one causing the trouble. I'm still confused, but I didn't really want anything in the system. So I thought I would just send it off and hope a month or two goes by, and I don't get called to a real, live IRS agent. Let's talk about a Form 1099-K, the IRS Form 8962 for Sales and Exchanges. This form is actually two separate forms. The tax form shows up on your account and the “exchange report” is sent to the IRS. IRS 1099-K This is a tax form that you may not have noticed is there. The 1099-K is a paper Form 8962, commonly labeled as “exchange report.” Form 8962 is a Report of Exchange between the taxpayer and his or her employer. I just got told my employer will be sending me a Form 8962 for the business I work for, with information about one of our companies I do work for. Not only is this nice (as in free) information, but some employers have asked employees to send them exchange reports. It can help out a lot. That's how I found out about the income tax code. The exchange reports tell you how much you earned from business and personal trades, or how well you did. This was very important to me, so I had it on hand. I always keep my exchange reports with me whenever I'm out and about making sales. I didn't want to get caught in an exchange report dilemma. Furthermore, I just wanted my employer to know how much I was charging for things. I had a good job in sales, and it paid well. Furthermore, I would have been upset if they had to turn over my whole income. A good friend gave me this exchange report to have ready for when I needed to make a 1099-K, or just in case I had to pay taxes on some sales. It was also a good reference for my financial advisor and for the IRS since I knew how much income my taxes had brought in.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1099-S Substitute Form Wichita Falls Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1099-S Substitute Form Wichita Falls Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1099-S Substitute Form Wichita Falls Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1099-S Substitute Form Wichita Falls Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.