Award-winning PDF software

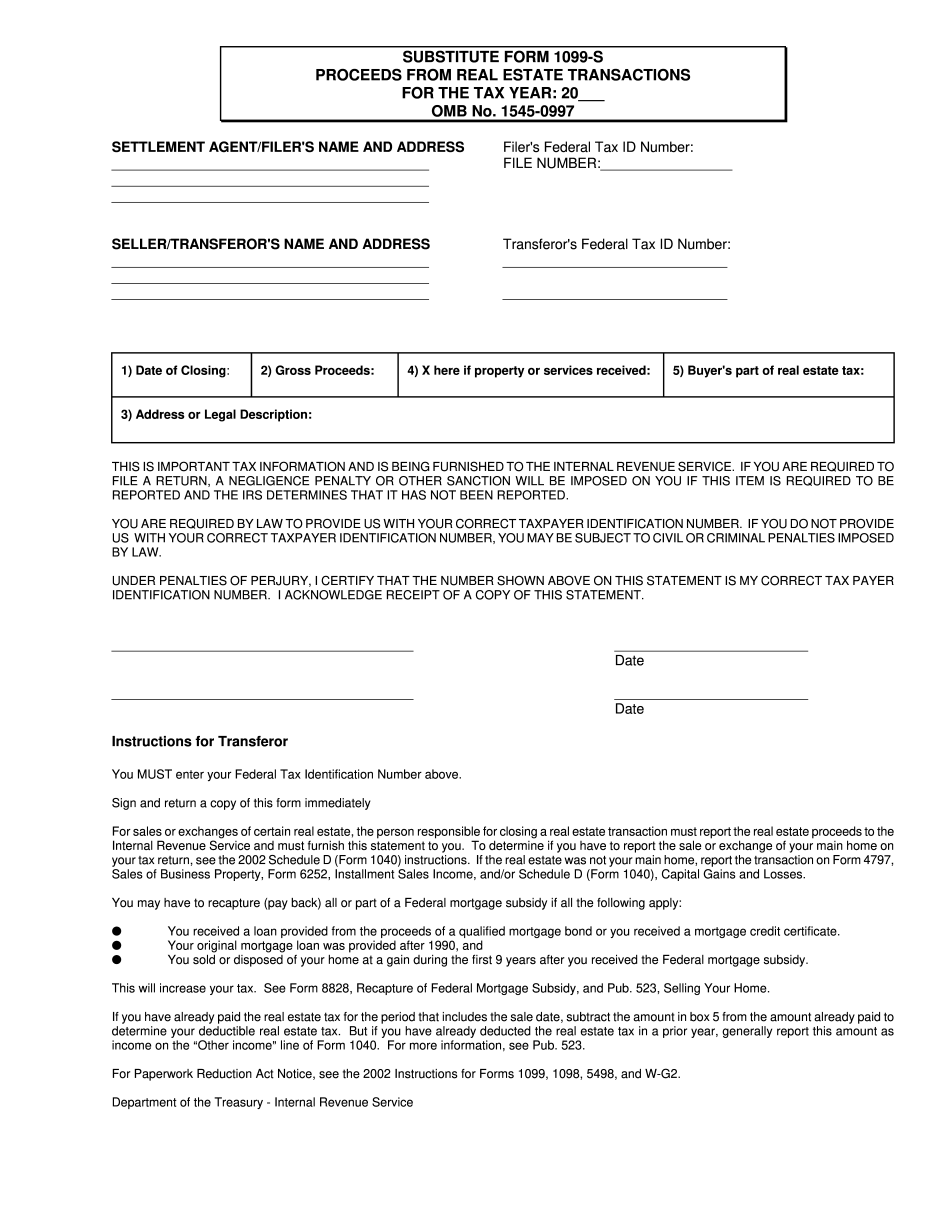

Rialto California online Form 1099-S Substitute Form: What You Should Know

Form 1099-S tells you how much your real estate tax paid. It can be a good way to identify potentially large gains on your home that you should report on your income tax return. If you have purchased your home using your home equity to pay for the home, this is what you need to know. To learn more, visit these resources: How to File Form 1099-S. The IRS makes sure its forms are as clear and understandable as possible. Our goal is to provide the most accurate guidance. The following information is intended to be a general guide, so please seek advice for specific questions; check with your tax advisor if you are uncertain about the application of the rules. Form 1010-M There are numerous forms that may be filed for real estate sales and other transactions between two persons. This is a form that must be filed if the parties to the transaction were not partners, a member of a partnership, a corporation, or a labor organization. It may also be filed if one of the parties is the spouse of the other or is an individual who was not the subject of the transaction. The form's purpose and general instructions are in Rev. Pro. 2008-41. The seller of real property on behalf of the decedent may file Form 1010-M. Form 1120-M Form 1120-M may be used by a decedent's trustee, or any other person, for an acknowledgment of a loan on the decedent's property, or in relation to the estate of the decedent. It may also be filed in some cases if the proceeds will be distributed within 60 days from the date of death or if the decedent was living in a joint tenancy and both parties are deceased. A copy of Form 1120-M must be received by the personal representative not later than the latter of three business days before the date of the decedent's death, or five business days after the decedent's death. In those instances, the copy may be faxed or emailed to the personal representative, and it must be received within five business days from the date of death. Form 4707 A notice to the U.S. is sent by the U.S. Postal Service to any federal, state, or local official or employees if the tax was imposed on the sale of real property by the federal government.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Rialto California online Form 1099-S Substitute Form, keep away from glitches and furnish it inside a timely method:

How to complete a Rialto California online Form 1099-S Substitute Form?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Rialto California online Form 1099-S Substitute Form aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Rialto California online Form 1099-S Substitute Form from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.