Award-winning PDF software

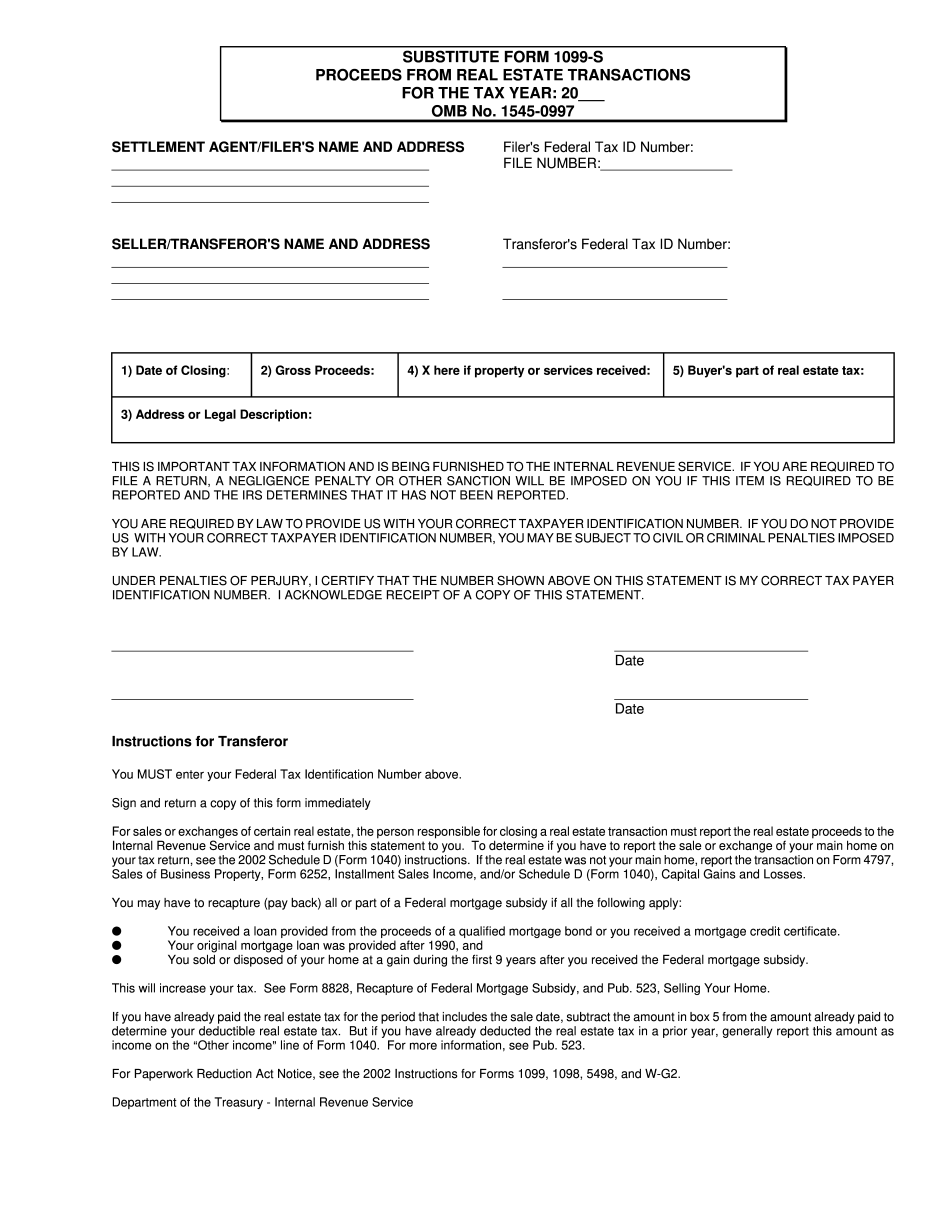

Santa Ana California Form 1099-S Substitute Form: What You Should Know

California Tax Return Transcripts, which contain information on income. An income tax returns has not been returned until the payee has verified the information. If you are a tax-fraud prevention client of our California Tax Fraud Protection Agency and are unable to resolve your tax refund or other issue with the IRS, we offer telephone assistance to the extent we are able to. You may reach us by calling. You may also request help by filling out the request by fax below. For tax-fraud prevention purposes, please complete the following document (PDF) to electronically certify you are a fraud reduction client (IRS Form 8671-01). A Taxpayer Identification Number (TIN) of the taxpayer to be certified is requested. The Taxpayer Identification Number (“TIN”) is issued by the Internal Revenue Service to each taxpayer, to assist the IRS in matching taxpayers with tax return and tax information by using the information stored on IRS returns. To obtain a TIN, the taxpayer must first have proof of identification or be a resident of the United States for whom TIN is a legal requirement. To view the Taxpayer Identification Number, click on this link:. Once the required information has been entered, you will see your Taxpayer Identification Number displayed in orange. Click on the yellow button that says “Copy TIN.” (Important Note: This information cannot be saved on a computer). Substitute IRS Form W–2 — Berkeley County The Form W-2 is the report of your employer. The employer must enter this information when each employee makes a California Wage Payment or pays an amount to the California State Unemployment Insurance (UI) or California Developmental Disabilities Insurance (DI's) program, for whom they are a qualified provider. A substitute W-2 must be obtained, at the time the employer report, before any wages are paid or any amounts are paid. The substitute W-2 must be submitted to the Caliph by the payer for each dependent, unless the W-2 is not submitted and the payroll clerk is of the opinion that the wages and amounts paid would not be covered through the Caliph. If a parent is on a joint and several accounts, the substitute W-2 should be provided for each dependent.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Santa Ana California Form 1099-S Substitute Form, keep away from glitches and furnish it inside a timely method:

How to complete a Santa Ana California Form 1099-S Substitute Form?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Santa Ana California Form 1099-S Substitute Form aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Santa Ana California Form 1099-S Substitute Form from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.