PDF IRS Form 1099-S Substitute Form 2017-2025

Show details

Hide details

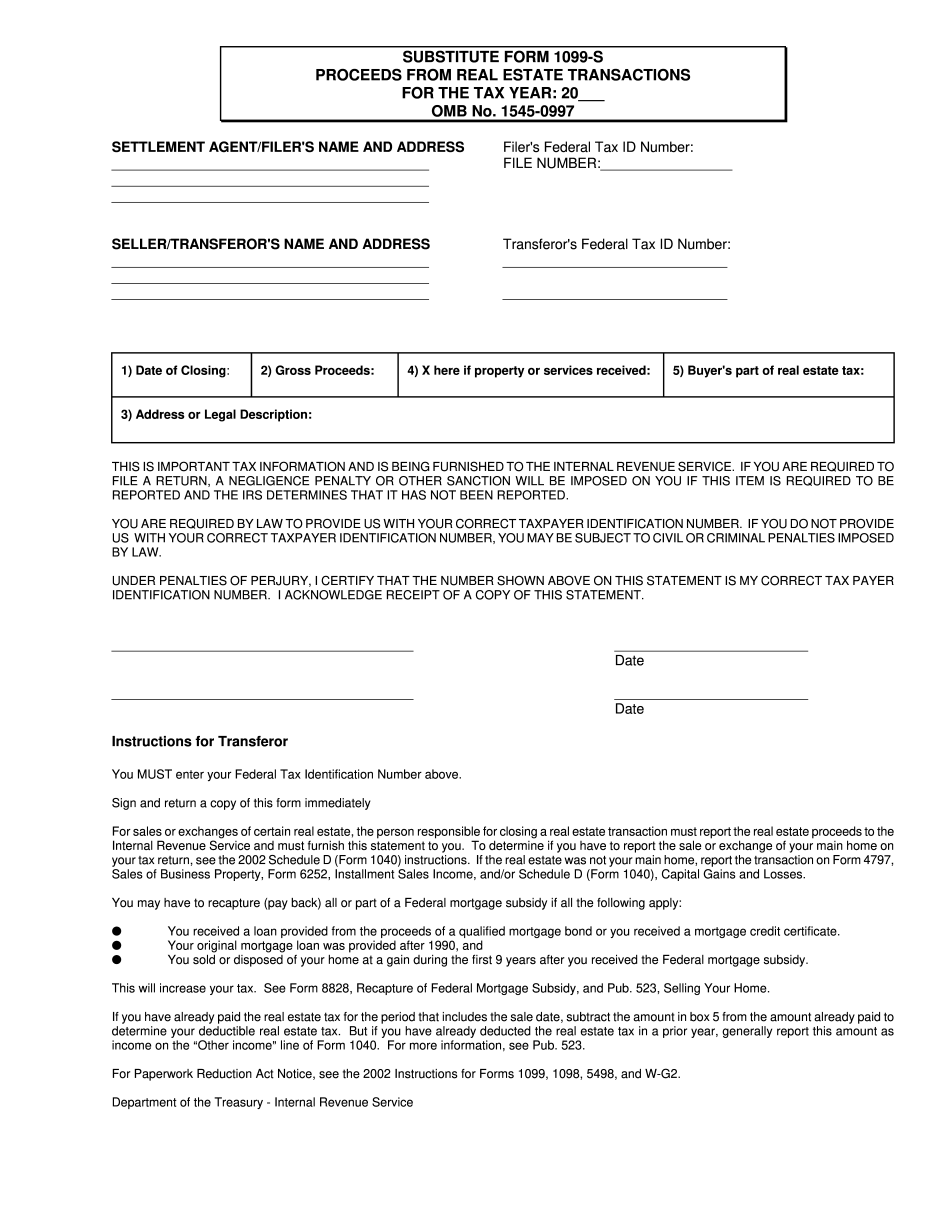

EQUIRED TO FILE A RETURN A NEGLIGENCE PENALTY OR OTHER SANCTION WILL BE IMPOSED ON YOU IF THIS ITEM IS REQUIRED TO BE REPORTED AND THE IRS DETERMINES THAT IT HAS NOT BEEN REPORTED. YOU ARE REQUIRED BY LAW TO PROVIDE US WITH YOUR CORRECT TAXPAYER IDENTIFICATION NUMBER* IF YOU DO NOT PROVIDE US WITH YOUR CORRECT TAXPAYER IDENTIFICATION NUMBER YOU MAY BE SUBJECT TO CIVIL OR CRIMINAL PENALTIES IMPOSED BY LAW* UNDER PENALTIES OF PERJURY I CERTIFY THAT THE NUMBER SHOWN ABOVE ON THIS STATEMENT IS MY ...

4.5 satisfied · 46 votes

1099-s-substitute-form.com is not affiliated with IRS

Filling out Form 1099-S Substitute Form online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guideline on how to Form 1099-S Substitute Form

Every person must declare their finances in a timely manner during tax season, providing information the Internal Revenue Service requires as precisely as possible. If you need to Form 1099-S Substitute Form, our reliable and intuitive service is here at your disposal.

Make the following steps to Form 1099-S Substitute Form promptly and accurately:

- 01Import our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official instructions (if available) for your form fill-out and accurately provide all information requested in their appropriate fields.

- 03Fill out your template using the Text tool and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Make use of the Highlight option to accentuate particular details and Erase if something is not relevant any longer.

- 06Click the page arrangements key on the left to rotate or delete unnecessary document sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or select Mail by USPS to request postal document delivery.

Select the best way to Form 1099-S Substitute Form and declare your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Substitute Form 1099 S?

Online solutions help you to organize your document administration and raise the efficiency of your workflow. Observe the short guide to complete Irs Substitute Form 1099 S, avoid errors and furnish it in a timely way:

How to fill out a 1099 Substitute Form?

- 01On the website with the form, click Start Now and move for the editor.

- 02Use the clues to complete the relevant fields.

- 03Include your personal details and contact information.

- 04Make certain that you enter suitable information and numbers in suitable fields.

- 05Carefully verify the written content of the blank so as grammar and spelling.

- 06Refer to Help section in case you have any concerns or contact our Support team.

- 07Put an electronic signature on the Substitute Form 1099 S Printable using the help of Sign Tool.

- 08Once document is finished, press Done.

- 09Distribute the ready blank through electronic mail or fax, print it out or download on your device.

PDF editor enables you to make modifications to the Substitute Form 1099 S Fill Online from any internet linked device, customize it according to your needs, sign it electronically and distribute in different means.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1099-S Substitute Form?

This form is issued for purposes of reporting taxable income generated from a qualified project to Form 1099-S and to facilitate filing the appropriate annual Schedule C. The purpose of the Form is to assist the taxpayer with the preparation and filing of Form 1099-S. If the same person who has generated the qualified project report is responsible for another qualified project or a group of related qualified projects totaling more than 5 million, Form 1099-S also is useful for information reporting purposes for those projects.

For information reporting purposes, Form 1099-S should be used with the other information reported on the Schedule C and included on Form 1099-S. The information may be submitted on the same check or in electronic form (e-file) and should contain the same information as other Form 1099-S. No income is reported for income generated by a qualified project that is owned or leased by a governmental unit. If the taxpayer uses an electronic filing system to complete the form, the information reported on Schedule C may be processed and reported electronically as a Form 1099-K at the end of the year.

For information reporting purposes, Form 1099-S should be used on forms that are filed with, or are accepted on, a paper form (for example, Form 1040, Form 1040NR or Form 1040NR-EZ), or a paper form provided by the payer or the payer's agent. Where the payer or payer's agent receives and processes Form 1099-K electronically, a Form 1099-K is not issued.

I received a Form 1099-S for my 2016 income year. What do I do with it?

The most convenient way to deal with your Form 1099-S is to deposit it into a bank. You should then send it to your authorized payment processor, eInvoices.com, the IRS, or an individual on Form 1040X. Generally, it is not necessary to mail Form 1099-S directly to the IRS.

When sending your Form 1099-S directly to your authorized payment processor, we recommend completing and mailing Form 1099-S to us, so we can process it and send you an electronic confirmation. To obtain Form 1099-S, simply select the appropriate option below.

Option 1. Complete Form 1099-S directly from your bank account or email, by using the provided instructions.

Option 2.

Who should complete Form 1099-S Substitute Form?

If you make gifts to businesses, the Form 1099-S that you submit should reflect any amounts that are includible in your income on your tax return. Gifts to individuals will be adjusted to reflect any income that may be allocated to each individual. For example, if you receive a 300 gift from a business partner, your Form 1098-S should reflect 75 of income and 300 of deductions. If you receive a 300 gift from a business partner, your Form 1098-S should reflect of income and of deductions.

For more information on income, deductions and credits that may be allocated to you as well as IRS resources for information on your tax year and to find out your current filing status, visit IRS.gov/Form1098.

What if I receive a Form 1099-S for an amount the IRS says isn't my income, or I don't itemize deductions?

While there can be a number of reasons why an individual might receive Forms 1099-S, the best place to find out if Form 1099-S is legitimate is the IRS online publication, the Internet Exempt Organizations Database (EID). You can search using the name of the organization or type name of the organization. Or, if you'd prefer a printed catalog, search by organization name or the name of the form or the section of the code.

If I receive an unusual Form 1099-S for an item, why shouldn't I check it out?

If someone receives a Form 1099-S for an unusually high amount for an item, why not contact the recipient to discover if they've received a legitimate 1099? There may be possible reasons why the item exceeds IRS thresholds. For example, the recipient may be an individual who does not have a regular source of income.

When do I need to complete Form 1099-S Substitute Form?

You need to complete Form 1099-S to report the income of your employees on Form 1040, 1040A, 1040EZ, 1040, or 1040AES. You do not need to complete Form 1099-S to report the income of your partners.

Do I need to complete Form 1099-S? Form 1099-S is a substitution form. It must be reported on line 23 of form 1040. This form is not required to be reported by employees or partners who are required to file a Form 1099-MISC, Miscellaneous Income. Form 1099-S does not replace Form 3115. If you are a nonemployee partner in a partnership that uses a partnership return to report taxable income, there are two reporting forms to use: Form 3115, and Form 3121. However, you may be able to use the Forms 1099-PIV, 1099-MISC, or Forms 1099-K and 1099-QP if you follow the instructions. Form 1099-K and 1099-QP must be filed separately because they are reported on a different schedule. If you are nonemployee partner a partner and don't file a Form 3115, you should attach a photocopy of the partnership return for the tax year. The partnership return must have three columns: Form 3115, Schedule F, and Form 3121, Schedule L, together with line 18, the information in the table below. Enter all the information listed in the table below. Enter each line in the order it appears on the partnership return. Report income reported by each partner on lines 5, 6, and 7 of the partnership return. Do not complete Form 3114, Information Return, or Form 3117, Statement of Business Income and Loss, if your partnership does not have a partnership return. If you are a partner of a sole proprietor who has self-employment income, you are in the 1099-D group. If you are in this group, enter the amount received for all the items on the line below. If you are married and report the net income of one spouse on your Schedule B, enter the amount for your spouse.

Line 2: Employee Self-Employment Income

Income Received on a Schedule and Not Included on Your Schedule Enter all the income received from: The person or persons who provide property or services to you.

The person or persons you hire.

Can I create my own Form 1099-S Substitute Form?

Yes. You can use the following forms to create your own substitute forms for the 2016 tax year: Form 8821 (EIN: “S Corporation”), Form 1116 (EIN: “Partnership”), Form 2555 (EIN: “Employer”), and Form 8821-EZ (EIN: “Limited Liability Company”). The forms can be downloaded from IRS.gov, or you can obtain them at the address listed below and complete them to create your own. You will need your IRS W-2 or 1099-MISC to create a substitute, unless you've already received your W-2 or the W-2s you received from your employer were not withheld until you filed your federal income tax return.

How do I amend my Form 1099-S to show all income that has been distributed on a substitute Form 1099-EZ?

You can't amend a Form 1099-S to show all distributions (other than any distributions listed above) received on the form. Instead, you can use Form 1173 to amend the Form 1099-EZ to specify all distributions (except the above-listed distributions from the S Corp) received by the S Corp. To create a new Form 1173, complete form 1173-B (Form 8621-EZ), provide your employer's W-2 or 1099-MISC, and attach it to the original Form 1099-S.

How do I amend the Form 1099-MISC to show all distributions received from a tax-exempt S Corp?

Your employer can send you Form 1116 to report all distributions from the trust, including those from the S Corp. For more information, refer to Guide T4001, Tax-Exempt Fund Distributions.

Additional information on Form 1173-B, Tax-Exempt Fund Distributions, is available on IRS.gov.

Can I deduct the cost of the substitute S corporation Form 2555 when filing the tax return for the tax year?

No. You can't deduct S Corp tax-exempt distributions you receive on the substituted Form 2555. For more information, refer to Form 2555, Substitute for the Internal Revenue Code 1099-MISC.

Does the S Corp have to pay the corporate income tax on all distribution income from the S Corp?

Generally, the S Corp corporation does not have to pay corporate income tax on distributions received from the trust.

What should I do with Form 1099-S Substitute Form when it’s complete?

When you complete Form 1099-S or Form 1097-S, you must file the 1099-S or 1097-S. To file only the 1099-S or 1097-S, complete Form 1099-QZ. You also can complete Forms 1097-T for payments received, and Forms 8447 (V), 8971 (P), 8765 (S), 5987 (S), and 8447 (V) (all of which can be filed electronically).

When I receive Form 1099-S from my employer, the amount of the payment is less than 300. Are I eligible for a refund or credit?

If you received money from your employer, and it was less than 300, you are considered ineligible for a refund or credit under the Internal Revenue Code because the amount was not more than 10,000. However, if you exceeded the 300 dollar figure, the IRS allows you a 30-day extension to file your 2010 taxes.

What is a Form 1094-C — Report of Payment by Foreign Financial Institution?

An individual may receive Form 1094-C from foreign financial institution when the individual gives a payment to a beneficiary whose account is registered with the financial institution. Payments to non-U.S. citizens or aliens who are not U.S. citizens and residents are exempt from reporting.

If Form 1094-C is not filed as required, and the financial institution refuses to send you copies, you may be granted an extension if you provide the requested information and the financial institution agrees to provide the correct and complete form with the correct and complete instructions. For more information, see Publication 969, U.S. Individual Income Tax Withholding and Estimated Tax.

A foreign financial institution must file Form 1094-C to report and report the payment of a U.S. non-immigrant foreign earned income exclusion or foreign housing exclusion (as defined in section 1373 of the Internal Revenue Code, 26 USC 1373) made on behalf of a U.S. worker to a foreign employee by the non-U.S. financial institution. Financial institutions need not report wages paid by non-U.S. citizens or alien nationals as income. However, if a foreign financial institution violates a condition listed in section 1313(f)(1) of the Internal Revenue Code in regard to the withholding of U.S.

How do I get my Form 1099-S Substitute Form?

You may obtain a substitute Form 1099-S through us, but only if:

you were not required to submit Form 1099-S

your Form 1099-S was not filed with another tax year

your Form 1099-S has the same information on it as your main Form 1099-S

you have filed this Form 1099-S using any of the following options:

In this Example 3, you have to file Form 3903 with your individual tax return, but do not receive Form 3903-EZ. Your Form 3903-EZ, Form 3903, and Form 3903-F are in your tax filings from:

2012.

2013.

2014.

2015.

2016.

2017.

2017.

What documents do I need to attach to my Form 1099-S Substitute Form?

We need the following documents with your income tax return:

Your income tax return. Each form you submit to us must be accompanied by the following document: a completed Form 1099-S Substitute Form. If you did not file a Form 1099-MISC, you will need to attach a copy of a Form 1099-MISC to your Form 1099-S.

Your financial statements. These may need to be filed with your income tax return, including: your Balance Sheet, Profit and Loss from Business, Income Tax Statement, and Statement of Condition for any of the previous years.

You may be required to furnish additional documents that are not included on page two (i.e., copies of schedules, schedules and schedules) of your Form 1099-MISC.

Can a financial institution obtain an electronic copy of a Form 1099-K that I submit?

An electronic copy of a Form 1099-K is not made available electronically and cannot be verified online unless you provide us with one or more supporting documentation for the Form 1099-K to be provided. See the Instructions for Form 1099-K (PDF).

Can I submit Form 1099-K if I receive income from services other than a job?

The type of income you report as employment income does not determine whether your tax return, Form 1099-MISC, will need to be filed electronically. For example, if you receive income from any type of contract, prize, or royalty, an income tax return, Form W-2, or Form 1099-MISC, may be sufficient. However, your Form 1099-MISC must be filed with your Form 1040.

Can I use certain allowances or deductions as employment income instead of income from a job to reduce the basis of my personal property?

Your deduction for certain allowances or deductions (including certain contributions to an IRA) does not reduce the basis of your assets when you sell or otherwise dispose of your personal property or other assets. Therefore, a property or asset you used to satisfy the allowance or deduction can generally be kept as cash and be re-examined on a cash basis. However, certain assets you are allowed to keep as inventory and certain property placed for safekeeping with the U.S. Marshals Service are treated as excess inventory and are subject to a 10 percent excise tax when you sell or otherwise dispose of the inventory.

What are the different types of Form 1099-S Substitute Form?

There are two main forms of Form 1099-S, Form 1099-MISC and Form 1099-INT. The key difference between the two is that an entity is not treated as having received a foreign income tax credit (which is one of the two Forms 1099-MISC) if it receives the same payment for the same items each time it files for the same tax year. For purposes of IRS revenue, the only type of Form 1099-S that should be reported is Form 1099-S, “Payment of Withholding or Estimated Tax,” which the IRS mandates the receiving companies report.

Do Form 1099-S Substitute Forms have different deadlines?

Yes. When the recipient does not choose to certify that it received the payment, payments are required to be reported on the first day of the following tax year.

What should the recipient of a Form 1099-S be prepared to report?

The recipient for a Form 1099-S Substitute Form must:

1) Include on Form 1099-S its payment amount; and

2) In the “Substantially all income” and “Substantially all items” sections, list items “paid or incurred” to it on the respective form by the recipient for the year in which it received the payment.

What does the IRS used to identify the receiving company on Form 1099-S that files for a particular tax year?

The IRS uses “reporting address.” A “reporting address” means the primary address that is used by the recipient's parent, parent-in-law, spouse, child or parent-in-law's spouse to send an itemized payment or report a payment on or through a reporting address.

If a reporting address is not reported at the time an entity files for a particular tax year, the information reported on the Form 1099-S or 1099-MISC will not be accepted by the IRS.

For example, suppose that a parent, parent-in-law, spouse, child or parent-in-law's spouse did not maintain a primary address when sending his or her Form 1099 Forms that the IRS accepts for reimbursement of a payment it paid to the entity. The parent would not be considered to have a reporting address because the parent did not maintain a primary address at the time of the payment.

How many people fill out Form 1099-S Substitute Form each year?

There are numerous types of Form 1099-S, depending on the type of payment and the type of business, the type of product being sold and the payer.

For information on the difference between Form 1099-S and Form 1099-MISC, please see our article on Form 1099-S and 1099-MISC.

Where can I find Form 1099-S Information?

For instructions on how to use Form 1099-S, see the Instructions for Form 1099-S below, or you may go to the Form 1099-S section of the IRS website, as shown below:

If you were a self-employed individual for the year:

If you were an employee under an employer's plan for the year:

If you were an entity under an employer's plan for the year:

If you were a nonprofit corporation for the year:

If you were a qualified individual for the year:

For more information on the types of Form 1099-S available for the following types of payments, please visit our webpage, Forms 1099-S and 1099-MISC and the Forms and publications page on our website.

If you received:

• Any payment under the following: “Business, Professional, and Capital Gains” or “Self-Employment Income,” or

• Any payment under the following: “Pensions,” “Fidelity Charitable Contributions,” “Health Savings Accounts,” or

• Any “Other Payments,”

you should consider a refund. This means if the IRS says you can receive a refund, we will be refunding you.

Is there a due date for Form 1099-S Substitute Form?

Yes. You don't need to use Form 1099-S Substitute form immediately upon the filing, but must do so by the earliest of: (1) the filing required date or (2) the date the return is due or sent to you.

1099-F — Nonprofit Organizations

Filing requirements for all nonprofit organizations are outlined in Publication 519, Tax Guide for Nonprofit Organizations, and included at IRS.gov. The key question is whether your organization qualifies as a nonprofit organization and that it is considered to be a small business in its industry.

Nonprofit organizations, like businesses, are subject to income tax, but unlike businesses, nonprofit organizations don't receive a corporate tax exemption. However, nonprofits can get a variety of special tax breaks and other non-tax benefits. For more information, refer to Publication 519 or check IRS Pubs. 465 and 469 for additional information.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here